Investment Approach

We combine leading economic research with strategic low-cost security selection to help you meet your long-term objectives while living your life today.

WJA Receives No Product Sales or Commissions

While numerous investment managers and brokers promote high-performing actively managed funds, many have hidden fees and management costs which can diminish your returns over time.

Low-Cost Security Selection

When selecting investments for your portfolio, we focus on performance while minimizing the costs that could be cutting down your returns. We do not sell our own investment products, and we don’t receive payment from anyone for recommending theirs. Unlike Brokers and Hybrid firms that charge commissions and receive kickbacks from mutual funds, we’re incentivized to keep costs low. When working with Willis Johnson & Associates, there are no product sales, no hidden fees, and no commissions — Simply great advice with your best interest in mind.

All investment advisors have a fiduciary duty to act in their clients’ best interest. WJA is not free from all conflicts and thoroughly discloses its conflicts of interest within Form ADV Part 2A and Part 3, located on the Firm’s website.

Invest Using Proven Economic Research, Not by Chasing Trends

We don't react to headlines or buy what's hot believing we can pick the out-performer. We build our portfolios based on the principles of modern finance and Nobel-Laureate research.

Evidence-Based Investing

To help achieve your objectives, we use a well-diversified index fund-based investment approach established and regularly reviewed by our Investment Committee. By holding a truly diversified array of investment options, you can minimize risks and losses during market dips and improve your portfolio performance over time.

We work with you to design a portfolio that bridges where you are coming from to where you are headed. This practical and customized approach tailors your portfolio to your needs. Over the long-term, we believe that certain tilts within a portfolio (like over-weighting value stocks or small-size equities) tend to perform well over time based on the proven Nobel-Laureate academic research, including:

Foundational Principles of Our Investment Approach

Asset

Allocation

Beebower Brinson and Singer

An investment strategy balancing asset classes within a portfolio according to your goals, risk tolerance, and time in the market.

Efficient Market Hypothesis

Eugene Fama, Ph. D.

The theory that the majority of information available to investors is reflected in share prices, which makes it difficult to outperform the market even through expert stock selection or market timing.

Modern Portfolio Theory

Harry Markowitz

A theory for how investors can construct their portfolios based on a given level of market risk to maximize their expected return. The Modern Portfolio Theory can be particularly efficient for portfolios using ETFs.

Intertemporal

CAPM

Robert Merton

The theory that investors participating in the market have different investment needs, time horizons, and constraints when constructing their portfolios.

“Asset Allocation is the primary driver of performance comprising 93.6% of returns.”

- Beebower Brinson and Singer

Take Advantage of Market Performance While Seeking to Mitigate Risk.

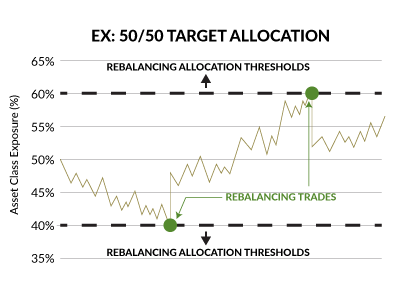

When portfolios become overweight and move away from your target allocation, we strategically trim profits during a market run-up and rebalance.

Systematic Target Band Rebalancing

We believe that systematic rebalancing is a core pillar of portfolio management. Instead of only looking at your account on a quarterly or annual basis like some advisors, we check your investments daily. Our proactive approach helps to keep your accounts aligned with your preferred asset allocation. When positions deviate significantly from their long-term target, we: 1) Trim the profits to capitalize on a run-up, or 2) Buy recently-battered positions at a lowered cost.

How does it work?

Strategic target band rebalancing uses real-time market shifts to reallocate funds in accordance with your target asset allocation. We believe target band rebalancing limits your exposure to risk by keeping you close to your target asset allocations as the market shifts and has a tendency to have you buying low and selling high.

Avoid Unnecessary Taxes

Rather than letting taxes eat into your returns, our team looks at them alongside your investments to ensure you get to keep your gains, not the IRS.

Tax-Informed Investment Decisions

Investment choices can have significant tax consequences, and no one wants a higher tax bill. Our integrated team of investment experts, Certified Financial Planners™, Chartered Financial Analysts®, and on-staff CPAs offers expertise across multiple specialties. This collaborative approach enables us to make investment choices that minimize tax liabilities using strategies such as

Asset Location

Determining which types of investment options (stocks, bonds, muni’s) should be held in your various IRA, Roth, or investment accounts to get the best returns while minimizing taxes.

Income Tax Smoothing

Coordinating your investment decisions alongside your tax planning to reduce taxes over time.

Tax Loss Harvesting

"Harvesting" your investment losses each year to lower your tax bill over time.

Stay On Track With An Objective, Long-Term Approach

Understanding the market's historical returns and maintaining a long-term perspective can help

reduce impulsive investing decisions that lessen returns over time.

reduce impulsive investing decisions that lessen returns over time.

Rooted in Behavioral Finance

One of the key strategies to remember when investing is to keep an eye on the long game. When we invest, we take a systematic approach to avoid the impact that emotion and biases (from both our advisors and our clients) can have on a portfolio. What we focus on is implementing what research has proven — while long-term strategies don’t show value in day-to-day results, they play out over time and tend to have greater returns over a 3 to 5-year period.

Tailored Strategies With You in Mind

When working with us, we put you and your loved ones at the forefront of every decision. As life stages change or major life events arise, our team ensures that your plan and investment portfolio evolve alongside you. Whether your situation changes at work or at home, our clients can rest assured that there is always a tailored plan in place taking their individual risk tolerances, future cash flow expectations, and long-term goals into account.

Investment Advice Without The Hidden Fees

Our clients’ long-term success guides what we do. As one of only 9% of RIA-only firms, we uphold the fiduciary standard by only putting investments in your portfolio that we believe in and that are in your best interest.

Unlike broker‑dealer and dual representatives, at Willis Johnson and Associates there are no product sales, no hidden fees, and no commissions.

We focus on what’s right for you and your future, offering only great advice with your best interest in mind.

All investment advisors have a fiduciary duty to act in their clients’ best interest. WJA is not free from all conflicts and thoroughly discloses its conflicts of interest within Form ADV Part 2A and Part 3, located on the Firm’s website.

Many firms focus solely on investments, but reaching your financial goals requires so much more.

Alongside picking the right company benefit elections, saving strategies for your 401(k), and planning for the next generation, investments are only one piece of the puzzle when it comes to retirement.