Achieving your life-long goals starts with a plan.

Whether you're saving to put your kids through college or working towards financial independence in retirement, it's essential to know how all the aspects of your financial life are connected to help you stay on track. How you handle your finances often needs to evolve with you through each stage of your life and can get more complicated as you accumulate wealth. At Willis Johnson & Associates, our proactive and comprehensive approach to wealth management means that you can be ready for wherever life takes you next.

Getting to Know You in Initial Meetings

Before Becoming a Client

Juggling your finances alongside a successful career can add unnecessary stress and confusion to an already-busy lifestyle. We understand the importance of finding the right advisor for you and your family to simplify your financial picture. Before becoming a client, we offer a complimentary first meeting where we'll learn about you, your financial concerns, and where you want your wealth to take you.

WJA's Consultative Approach

Meeting 1 - Introductions

1-on-1 with an advisor to learn about you, your family, and your goals while offering you an introduction to our firm's services

Meeting 2 - Assessments

Your advisor performs an employee benefits analysis, investment review, and tax return assessment to uncover missed opportunities.

Meeting 3 - Guidance

Your advisor offers actionable recommendations and strategies to help you reach your goals whether you decide to work with us or not.

What We Look at During Initial Meetings

The goals of initial meetings are to discover if our firm can offer you value in your financial scenario and enable you to get to know us and our areas of expertise. Our advisors take a consultative approach to understand you, your goals, and what opportunities may be available to you. By our second meeting with you, an advisor will walk through the following steps to see what strategies and recommendations to recommend to help you reach your financial goals.

Company Benefits & Compensation Assessment

Walking you through your 401(k) portal, executive compensation package, and the various elections available to you by your company allows an advisor to offer recommendations on how you can optimize them going forward.

Tax Planning & Optimization Analysis

Discussing tailored tax strategies with an advisor to see the tax planning opportunities available for you to take advantage of, gain clear insight into which tax obstacles you may face, and understand how we can help.

Investment Strategy & Portfolio Review

Understanding your approach to investing, openness to risk, and current asset allocation can help advisors identify gaps and develop a tailored investment strategy to help you reach your goals.

What Our Clients Have to Say About Us

WJA Client

via Google Reviews

I have had the pleasure of working with Willis Johnson and Associates over the years. What has impressed me the most about the firm is its knowledge about the oil and gas industry. Its team really knows this space, and its services reflect that knowledge. Beyond this, team members have a high touch and thoughtfulness with each relationship they handle. I'd highly recommend the firm, especially if you're an executive in or about to retire from the oil and gas industry (current client, unpaid, April 2020).

WJA Client

via Google Reviews

We have been with Willis Johnson & Associates for about 10 years now. We have developed a very high level of trust with their personnel and their investment strategies for our situation. I would highly recommend this company for investment advisory assistance (current client, unpaid, June 2021).

WJA Client

via Google Reviews

Willis Johnson & Associates has been excellent to work with. They have helped us achieve our goal of early retirement which allows us to do what we want (current client, unpaid, November 2021).

WJA Client

via Google Reviews

Our advisor (Sarah) does a wonderful job, helping us navigate volatility, not jamming rash decisions during these volatile times, and researching questions such as recommendations for senior living facilities (current client, unpaid, May 2022).

WJA Client

via Google Reviews

We have been heard, treated with respect and advised honestly (current client, unpaid, December 2021).

WJA Client

via Google Reviews

A great team that works closely with you to meet your short and long-term goals (current client, unpaid, April 2021).

WJA Client

via Google Reviews

Have been working with Willis Johnson & Associates since before I retired from Shell. Have been very satisfied with the level of service they provide. Would recommend them should you be interested in an overall financial advisor (current client, unpaid, June 2021).

Book a Complimentary Initial Meeting With an Advisor

Becoming a WJA Client

Choosing to partner with us isn't something we take for granted. We aim to give our clients peace of mind from day one, knowing that a team of financial experts is in their corner and invested in their success.

Communication and trust are foundational to long-lasting relationships, especially when it comes to your finances. We hit the ground running to make sure your first 60 days with us set you up for worry-free success.

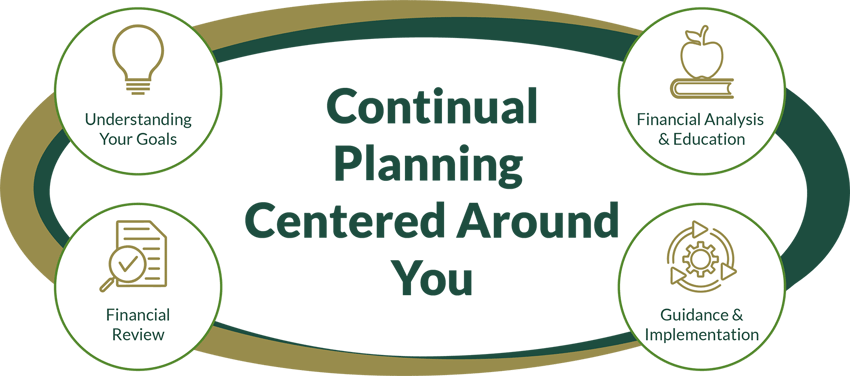

Ongoing Client-Advisor Relationship

Continuous Expert Guidance

Monitoring finances and staying on top of the tax law changes or market shifts can be exhausting. Our team makes it simpler for you by managing everything on your behalf so you don't have to try to juggle all the moving pieces on your own.

Boutique On-Call Service

We don't charge extra fees if you want to check-in with your advisor. We encourage you to do so as changes arise in your life or the markets so we can keep you informed.

Financial Plan & Portfolio Reviews

Twice a year, we do an intensive walkthrough of your accounts to see how you're aligning with your goals, discuss market activity, and outline what strategies we're leveraging to achieve your goals.

Tax Preparation & Filing Services

Tax management is a crucial part of accumulating wealth. As part of our holistic approach to financial planning, we offer tax return preparation and filing for our clients.

WJA’s Comprehensive Wealth Management Services

When it comes to growing your wealth, investments and taxes are only a small piece of the equation. Working with an advisor who can bring all your financial details together into a tailored plan for you can be the difference in achieving your goals or compromising them down the road. To ensure our clients' finances work together to reach their full potential, Willis Johnson & Associates' advisors explore and offer guidance on the services below.

Financial Planning, Goal Setting & Implementation

Investment Portfolio Management

Tax Planning + Preparation and Filing of Tax Returns

Benefit Analysis & Optimization

Insurance Evaluation

Charitable Giving

Trusts & Estate Planning

Education Planning

Retirement Planning

Budgeting & Cash Flow Planning

Consulting & Self-Employment Planning

Severance Package Evaluation & Planning

Your Dedicated Wealth Management Team

As a WJA client, you have a team of experts monitoring and working on your account to ensure seamless and continual optimization. Our team brings a wealth of experience and specializations in various fields of expertise. An example of the key members in every client's dedicated team are:

Lead Advisor

Manages your overarching financial plan & strategies

Servicing Advisor

Your designated contact for day-to-day updates and coordinating action items

Portfolio Manager

Oversees and manages investment accounts & strategy

Client Operations Manager

Administers all action items within your plan to ensure timely withdrawals, transfers of assets, and RMDs

Tax Director

Collaborates with advisors for tax-efficient strategies within your accounts

Fidelity Investments

We partner with Fidelity as a third-party custodian for accounts so you can see your funds at any time.

Industry Disclosures

What Makes Us Different

Fiduciary, Fee-Only Firm

With us, you don't have to worry about our recommendations coming with commissions or product sales. It's just great advice in your best interest 100% of the time.

In-House Tax Services

We prepare and file your tax returns as part of our tax planning to ensure the strategies we implement are tax-efficient.

Company Expertise

We know the ins-and-outs of your employee benefits, so you can make elections that help you build your wealth and make sure you're not leaving any money on the table.

Wealth Management Fee Schedule

| Household Assets Under Management | Annual Fee as % of Assets |

| First $500,000* | 1.20% |

| Next $500,000.01 to $3,000,000 | 0.90% |

| Next $3,000,000.01 to $5,000,000 | 0.85% |

| Next $5,000,000.01 to $10,000,000 | 0.65% |

| Next $10,000,000.01 to $20,000,000 | 0.45% |

| Next $20,000,000.01 and up | 0.40% |

Fees are calculated through a weighted formula using the assets under management (AUM) ranges listed above. Our minimum fee is $2,063 per quarter. Fees are paid quarterly in advance, and a client’s effective fee is determined by the assets under WJA’s management on the last business day of each quarter or for new accounts on the account's start date.

Fee Calculator

Investible Assets

= 0.95%

BILLED ANNUALLY

BILLED ANNUALLY