Specialized, Unbiased Financial Guidance

We look at your overall financial picture and build your priorities into a long-term plan that’s uniquely yours. Our fiduciary commitment ensures that our choices align with your goals and are always in your best interest.

Build Your Plan with Confidence

As a fiduciary, we serve your interests first and foremost. Maintaining your trust is paramount. We will only recommend products and services that meet your needs best, so you never have to question our dedication to achieving your goals.

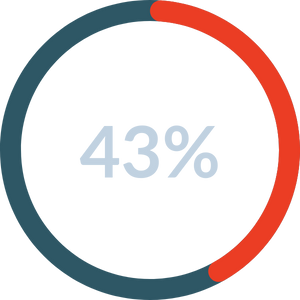

BROKER - DEALER ONLY

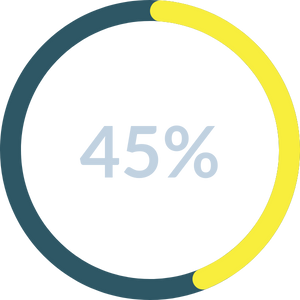

DUAL REPRESENTATIVES

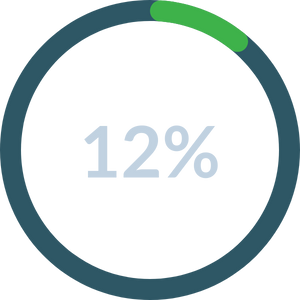

IAR ONLY

WILLIS JOHNSON & ASSOCIATES

What is a Fiduciary?

Willis Johnson & Associates is a fiduciary, fee‑only, registered investment advisory (RIA) firm. Our goal is transparency, so we only charge for the management of your assets and the advice we give. Unlike broker‑dealer and dual representatives, we do not sell investment products and commissions do not influence our recommendations for what’s right for you and your future. We believe in partnership and in the long-term success of our clients.

Minimize Your Tax Burden

When you are accumulating wealth, the last thing you want is to be giving the IRS more of your hard-earned savings than necessary. By making tax-efficient decisions every step of the way in your financial journey, you get to keep more of what's yours. Tax preparation can be stressful and time-consuming for most people, so we tackle that burden with our team of specialized experts to help give you financial peace of mind. Our in-house CPA and tax team work with our wealth managers to ensure seamless communication and implementation of tax-efficient financial strategies.

Alongside our industry-leading financial planning and asset management services, we offer:

Tax Planning

We perform a holistic review of your income and tax situation to ensure it’s efficient, and you’re retaining as much of your income as possible.

Tax Filing

One way we can contribute to your success is by helping you reduce your tax burden. Our in-house CPA and EA find tax-savings opportunities so more of your money can be wisely invested for the future.